In the investment ecosystem of 21st century, most of the energy and effort in investing has been channelled into momentum-centric investment strategies: locating your servers closer to the exchange, program trading to capitalize on tiny price movements, and indexing. However, directing capital to companies that can use it productively to generate wealth is ultimately the most profound benefit investors can have on society. Beyond allocating capital, investors also play a vital role in monitoring what companies are doing, pushing for transparency, and intervening to catalyse change if the capital employed isn’t generating the economic value it should. Therefore, institutional investors and understanding how they steer wealth creation are vital for leaders with a focus on business growth.

In the realm of private equity, Kaplan and Strömberg (2009) categorize three distinct avenues for enhancing value:

- financial engineering

- governance engineering

- operational engineering

While these value-boosting measures may not be entirely mutually exclusive, it is probable that specific firms prioritize certain actions over others. In a 2015 study conducted by Gompers, et al. at Harvard Business School, professors conduct a survey across 79 PE firms:

- to explore and document the detailed decisions made by private equity investors.

- to categorize different value creating strategies PE firms use.

In this article, we will discuss the results of the survey around the first pillar of value creation: financial engineering.

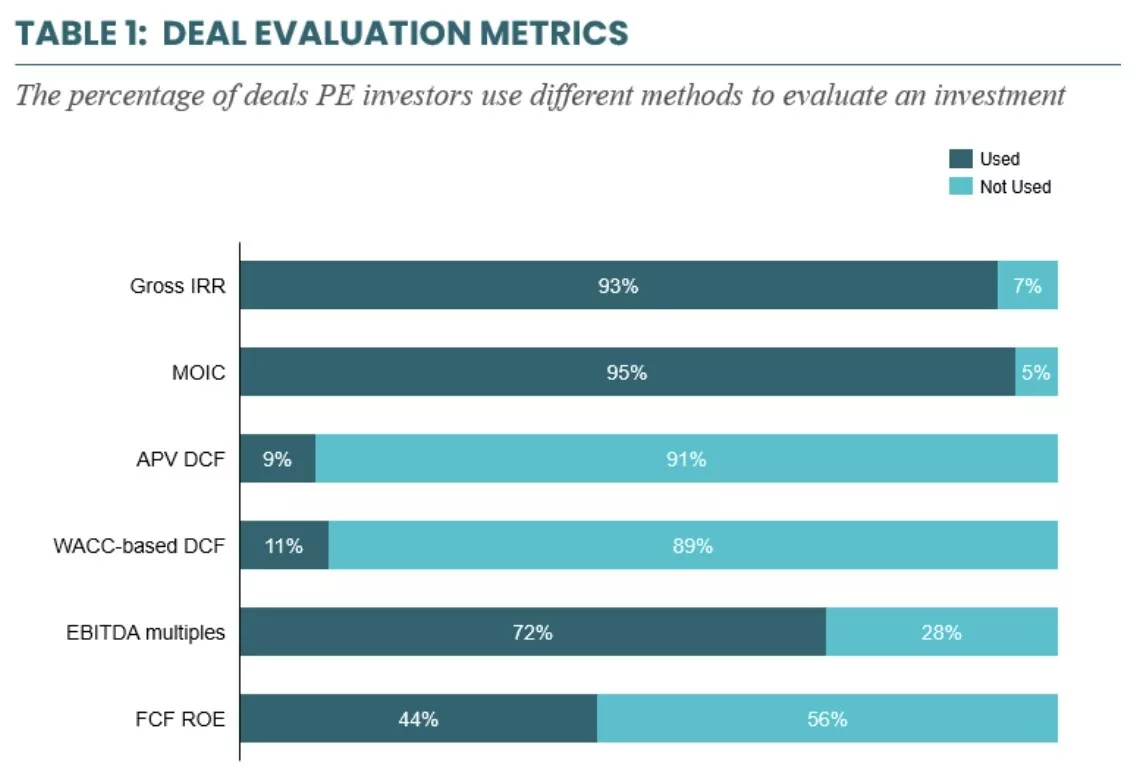

Vast amount of studies is clear at stating that better investments decisions are led by using an explicit asset pricing model (e.g., CAPM or Fama-French three-factor model) to estimate expected future cash flows and determine the discount rate, compared to alternative methods like Internal Rate of Return (IRR) or payback analysis. But contrary to financial theory, PE investors rely heavily on gross IRR, payback analysis and over 70% of them rely on valuation multiples (Table 1)– a group of evaluation methods that are known to give not the most reliable estimations. Furthermore, the survey reveals that 96% of PE firms calculate the terminal value (exit value) on a 5-year “standard” horizon, meaning that almost all investors expect a substantial financial value creation in only 5-years from the companies they invest in. This suggests that managerial decisions given by the investees should also aim 5-year value multiplying to keep stakeholders satisfied and to attract more investments by larger PE companies later.

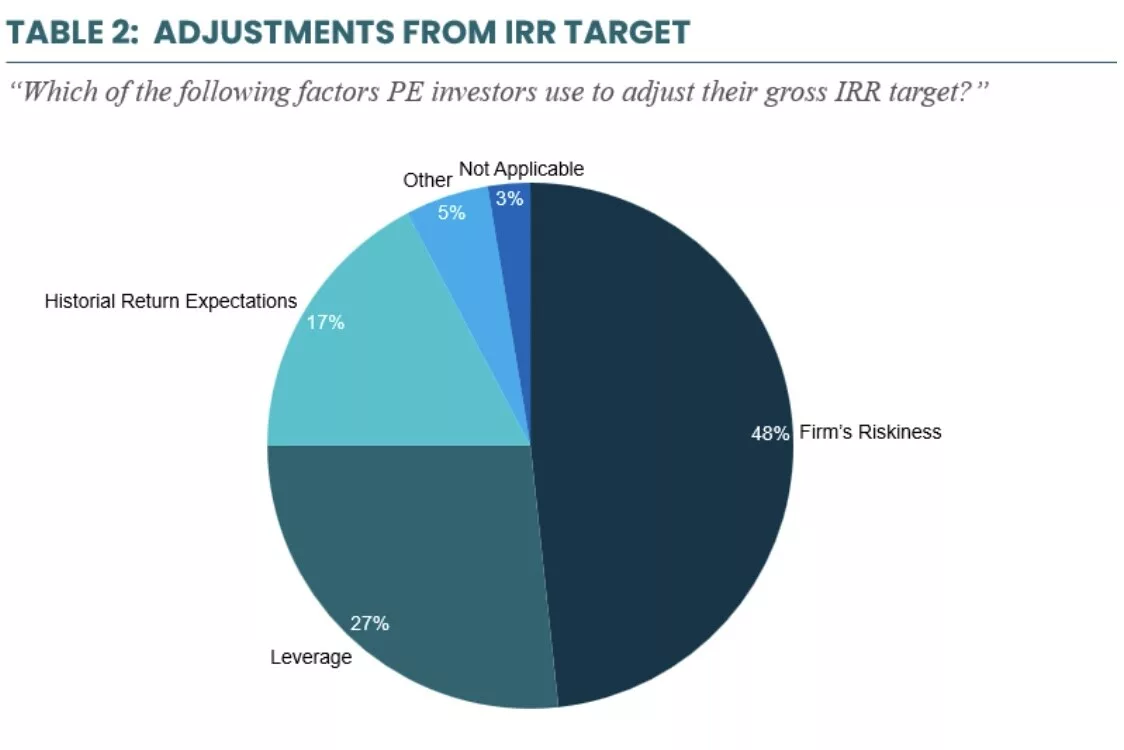

To estimate the economic value of an investment, before the deal happens, investors calculate the exit value of their investment. Again, the survey reveals that investors rely heavily on comparable methods. The primary considerations in evaluating a company with comparable analysis are industry and firm size, followed by factors such as growth, margins, and geography. This suggests that benchmarking practices within an investee company should revolve around identifying their competitors in terms of these factors and investigate best practices in such sample group. Notably, aligning the exit multiple with the entry multiple is in harmony with matching on industry and size. Another important pre-deal consideration is the IRR target that the PE company attaches to its investments. The target median IRR is 25% for PE companies. Targeting a 25% Internal Rate of Return (IRR) for an investment implies that the investor aims to achieve a compounded annual return of 25% on the initial investment over the holding period. This target IRR reflects the investor’s expectations for the investment’s performance and is often used as a benchmark to evaluate whether the potential returns justify the associated risks. Compared to individual investors risk appetite, this 25% highlights the interest of PE companies in investing in risky profiles that potentially will grow substantially in the holding period. The divergence from this 25% IRR target is either true for smaller PE companies or for companies with global footprint. The IRR target is dynamically adjusted, considering factors such as the firm’s specific risk profile, level of financial leverage, and the historical return expectations of limited partners (LPs). Notably, the firm’s riskiness is given primary consideration in fine-tuning the IRR for private equity (PE) investors. This underscores the significance of strategic focus on the commercial and operational facets of the company as the pivotal drivers toward achieving the ambitious IRR target.

Additionally, majority of LPs measure investment performance after the deal with absolute performance measures such as net IRR or net MOIC – rate of return after deducting fees, expenses, and other relevant charges from the cash flows generated by the investment. This is surprising given the attention to alphas (a measure of an investment’s performance compared to a benchmark) for public investments and relative performance for portfolio companies. Finally, according to post-deal results, the median net IRR is between 20-25% aligned and surpassing the IRR target. This result underscore the effectiveness of private equity strategies in achieving their ambitious investment goals.

To optimize decision-making processes and foster sustainable value creation, it is crucial for strategy advisors and managers to identify operational decisions that directly impact IRR. These decisions should align with overarching business objectives aimed at enhancing IRR, such as efficient cost management and reduction, accelerated revenue growth through strategic market expansion, streamlined operational processes to improve efficiency, and rigorous risk management to mitigate uncertainties. By integrating these key considerations into their strategic framework, organizations can not only meet the ambitious goals set by private equity companies but also align practical realities with expectations. This comprehensive approach ensures a more robust pathway to value creation through financial engineering and enhancing the overall success of private equity investments in a counterintuitive business environment.

Author: Defne ISLER